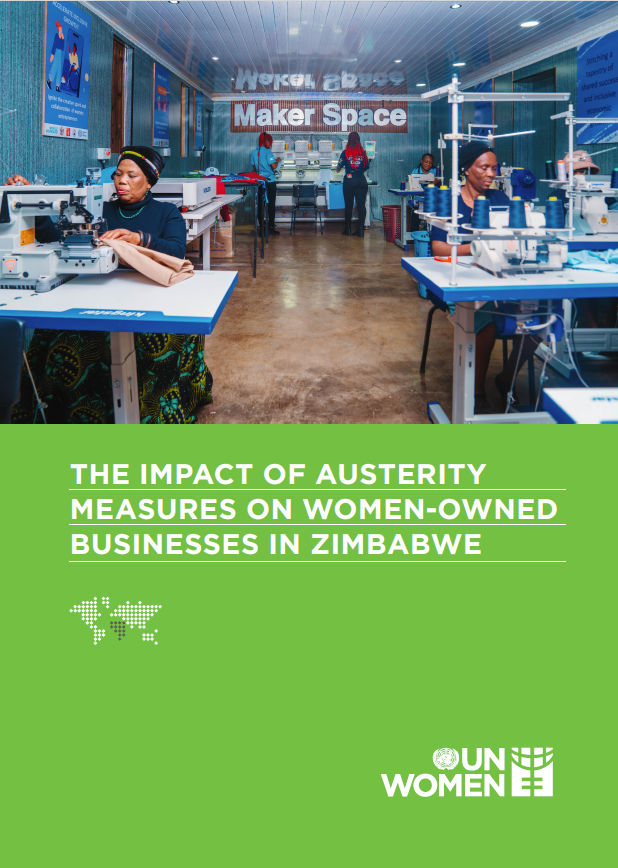

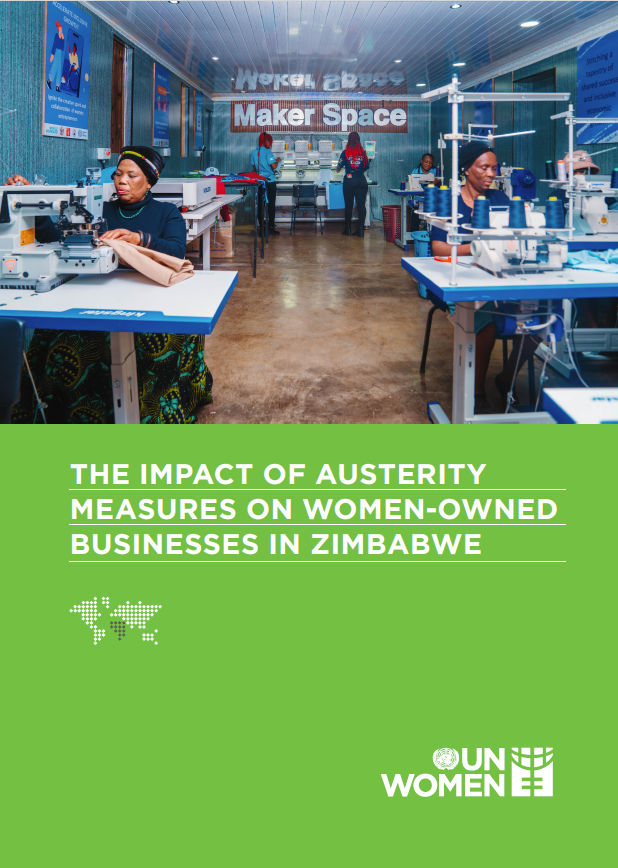

The Impact of Austerity Measures on Women-Owned Businesses in Zimbabwe

This study assesses the impact of Zimbabwe’s economic stabilization measures (2018-2023) on women-owned businesses and their access to regional markets. The period was marked by exchange rate volatility, inflation, and external shocks such as droughts, Cyclone Idai, and COVID-19. Fiscal and monetary policies remained largely gender-blind, prolonging economic instability.

Using surveys, interviews, and focus groups, the study analyzed 582 MSMEs across Zimbabwe. Findings reveal that most women-owned MSMEs emerged as survivalist enterprises due to economic hardships. These businesses are predominantly informal (68 per cent individually owned, 64 per cent unregistered) due to complex regulatory requirements.

Women-owned MSMEs are mostly micro enterprises (87 per cent), with no medium-scale businesses. Women constitute 71 per cent of employees, and two-thirds of these businesses are female-managed, though many owners lack advanced education and business skills. Initial capital investment ranged from US$101-500, mainly sourced from family and friends. Only 8 per cent accessed bank financing due to stringent requirements, and just 28 per cent have bank accounts, citing high costs and lack of trust in financial institutions.

Despite financial inclusion policies, access to formal financial services remains limited. Only 6 per cent of businesses received government incentives, and 5per cent received direct government support. Export participation is extremely low (2 per cent), hindered by limited market information, complex procedures, and high transport costs.

The study recommends gender-responsive policies, easing business formalization, improving financial access, strengthening business development services, enhancing skills training, and expanding export support to improve economic opportunities for women entrepreneurs.

View online/download

Order printed/published version

jack.abebe@unwomen.org